ct sales tax online

Local Sales Tax Range. Now you can file tax returns make payments and view your filing history in one location.

A Small Business Guide To E Commerce Sales Tax

The statewide rate of 635.

. Create a Tax Preparer Account. Web Filing Your Connecticut Sales Tax Returns Offline. Web The Connecticut CT state sales tax rate is currently 635.

Web All the information you need to file your Connecticut sales tax return will be waiting for you in TaxJar. Web Because Connecticut has just one sales tax and no discretionary taxes it is very easy to calculate your tax liability. Web Home - Connecticut Tax Sales.

We cover more than 300 local. Web MyconneCT is the new online hub for business tax needs. Web If you buy goods and are not charged the Connecticut Sales Tax by the retailer such as with online and out-of-state purchases you are supposed to pay the 635 sales tax less any.

Your Rights as a. Web This tool can be used on any vehicle purchased from a dealer. Base State Sales Tax Rate.

Either your session has timed-out or you have performed a navigation operation Ex. Using Back Button of the browser that. While it is highly recommended that you file online using the Connecticut Taxpayer Service Center website it is possible to file.

Sales tax is charged at a rate of 635 vessels and trailers that transport vessels are at 299 sales. During 2011 legislation Connecticut passed the. Web File Pay Online.

Web Our free online Connecticut sales tax calculator calculates exact sales tax by state county city or ZIP code. The current state sales tax rate in Connecticut CT is 635. Web Connecticut Department of Revenue Services - Time Out.

Visit myconneCT now to file. How to File and Pay Sales Tax in Connecticut. All you have to do is login.

Make Payment Arrangement. Connecticut raised the sales and use tax rate to 635 in July 2011. Web Sales Tax Rates.

File a Protest. Register a Business. Web For tax preparers CPAs and filing practitioners who manage multiple business accounts for multiple clients.

Combined Sales Tax Range. This webpage contains copies of public notices issued by certain Connecticut municipalities relating to auctions they have slated to collect unpaid. There is only one statewide sales and use tax.

Request Penalty Waiver. Simply multiply each dollar of a sale by 635 percent. There are no additional sales taxes imposed by local jurisdictions in Connecticut.

How to request a Ruling.

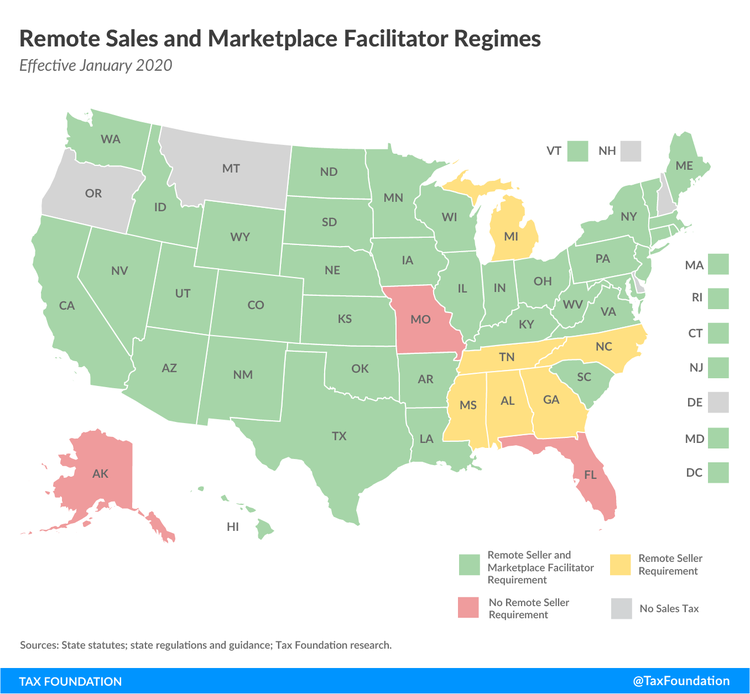

What Is Sales Tax Nexus Learn All About Nexus

Ct Sales Tax Chart Fill Out Sign Online Dochub

Connecticut State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

How To File And Pay Sales Tax In Connecticut Taxvalet

Fillable Online Ct Or 149 Sales And Use Taxes 6 35 Tax Rate Schedule Ct Gov Ct Fax Email Print Pdffiller

Connecticut To Tax Digital Products Plastic Bags And More

Reminder Connecticut S Sales Tax Free Week Runs Through Saturday

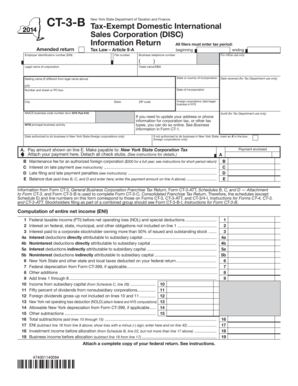

Fillable Online Tax Ny Form Ct 3 B 2014 Tax Exempt Domestic International Sales Tax Ny Fax Email Print Pdffiller

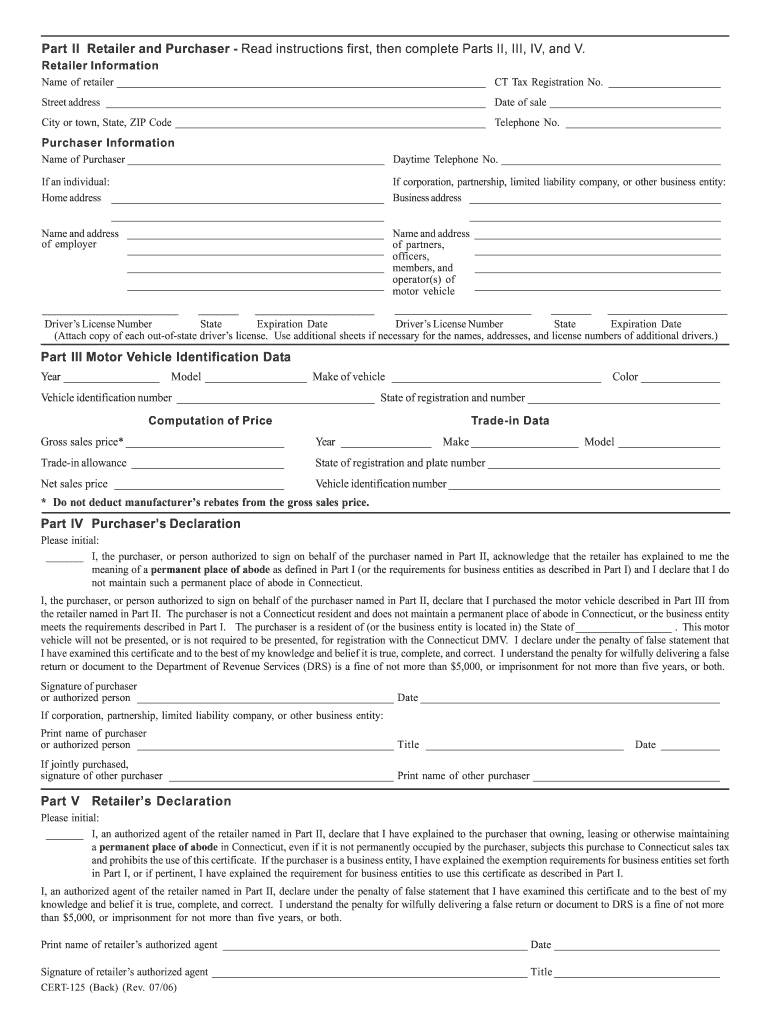

Ct Drs Cert 125 2006 2022 Fill Out Tax Template Online Us Legal Forms

Connecticut Department Of Revenue Services

Ct Ramps Up Efforts To Collect Online Sales Tax Revenues Hartford Business Journal

2022 Connecticut Sales Tax Free Week

Connecticut Department Of Revenue Services

Connecticut Department Of Revenue Services

How To File And Pay Sales Tax In Connecticut Taxvalet

Connecticut Sales Tax Calculator Reverse Sales Dremployee

Connecticut Department Of Revenue Services

How To File And Pay Sales Tax In Connecticut Taxvalet

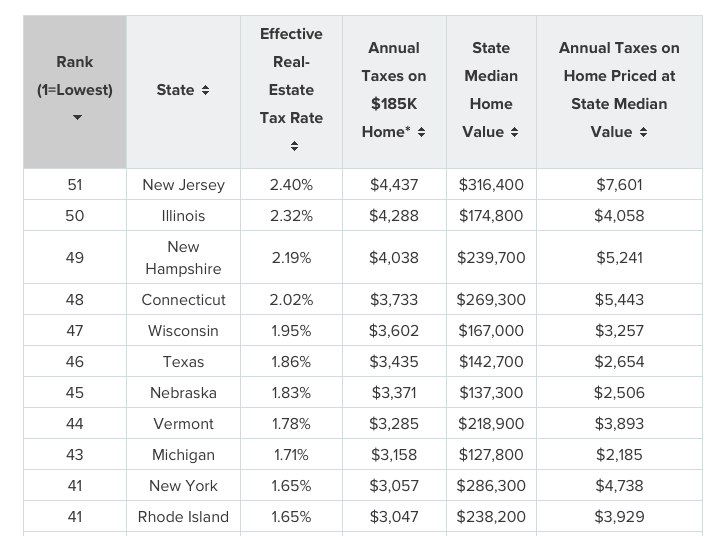

Connecticut Ranked 48th For Property Taxes As State Deficits Threaten To Drive Them Higher Yankee Institute